Cashflow Report – Portfolio Income During September 2012

October 6, 2012 Leave a comment

Welcome to the Investing for Cashflow Report – September 2012 Edition!

Each month, I review the portfolio income (i.e. paper income or income from investments) created from trading covered calls and create a “cashflow report” (hat tip to Pat Flynn over at Smart Passive Income). Analyzing trades is something every investor/trader should do on a regular basis, so this is my attempt to practice what I preach. The reports do the following:

- Help me track my progress towards financial independence

- Maintain my focus on increasing paper income and meeting my goals each month

- Provide an example of creating an income from investing/trading (actually making money!)

- Get your feedback on ways to improve

Enjoy!

Overview of September 2012

Not a lot going on in September. I guessed correctly that the markets would rise due to the European Central Bank and US Fed actions, but that is not an investing strategy. So I remained on the sidelines for most of the month, and let the QE events unfold.

The general markets (DJIA, NASD, SP500) were pretty quiet last month. Trading volume remained lower than average and prices rose in small increments when not reacting to the news.

Insights & Lessons Learned in September

I spent some time playing with spreadsheets last month, trying to creating new entry and exit signals. I ended up going with some really basic trendlines, so I no longer have to draw them by hand. You can see the results of my efforts in September’s last technical analysis.

The spreadsheets use actual closing prices, and then I played connect the dots for short term and mid term trends. Taking the change in price between two lows (or highs) and dividing it by the number of trading days in between gives me a price change per day. I then extend the price forward in time to the next option expiration date, creating a trendline and giving me stops for my underlying positions.

Not only do I have price targets for my stops, but I also can calculate how far away from the trendline an ETF is currently trading. This will be great for determining whether the covered call trade is worth the risk. I already calculate the percent return provided by covered call premiums. Now, I can compare that to the loss I would need to endure before the underlying ETF reached the trendline (i.e. my new stop price). If an ETF is 15% above its trendline and the covered call only yields 5%, the overall trade could lose 10% before the ETF found support or broke the trendline.

Don’t get me wrong here. Leveraged ETF’s are volatile, so this new trendline calculation is not fool-proof…it is just more responsive than my other program and allows me to control my losses a bit more.

Cashflow Report – Portfolio Income During September 2012 – Breakdown:

DRN-Direxion Daily Real Estate Bull 3X (ETF)

Premiums = $0.00

Dividends = $0.00

EDC-Direxion Daily Emerging Markets Bull 3X (ETF)

Premiums = $0.00

Dividends = $0.00

ERX-Direxion Daily Energy Bull 3X Shares (ETF)

Premiums = $209.36

Dividends = $0.00

FAS-Direxion Daily Financial Bull 3X Shares (ETF)

Premiums = $173.36

Dividends = $0.00

TMF-Direxion Daily 20+ Yr Trsy Bull 3X Shares (ETF)

Premiums = $0.00

Dividends = $0.00

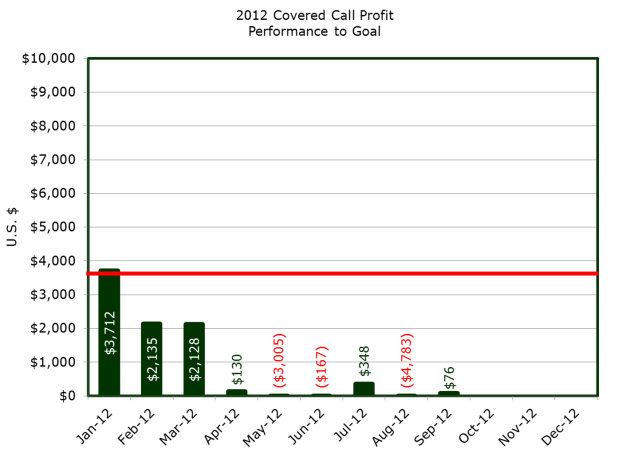

Cashflow = $382.72

Estimated Capital Gains/Losses = (307.05)

Goal Not Achieved

My ERX position was down ~$2 at the end of the month and my earlier FAS position ended up with a small capital loss on the underlying position. So my actual return came out pretty small. We’ll have to see where ERX ends up this month before calling it a wash.

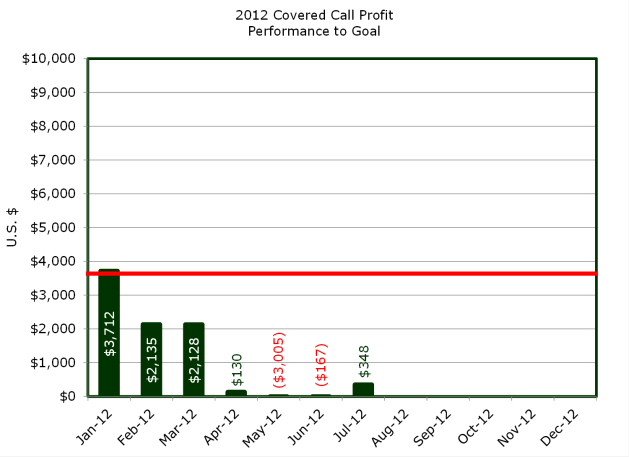

GOAL: Execute a covered call trading strategy that creates profit greater than $3,600 USD per month and deposits $3,600 USD per month into an expense account, for 3 months straight.

The Road Ahead

I kicked off September with one position in FAS (which was assigned), and then waiting for the smoke to clear from the QE craze that took hold. Towards the end of the month, I took my own advice and entered a position in ERX when it found support at my newly designed trendline.

Related Posts

- Cashflow Report: Portfolio Income during August 2012

- Cashflow Report: Portfolio Income during July 2012

- Cashflow Report: Portfolio Income during June 2012

- Cashflow Report: Portfolio Income during May 2012

- Cashflow Report: Portfolio Income during April 2012

- Cashflow Report: Portfolio Income during March 2012

- Cashflow Report: Portfolio Income during February 2012

- Cashflow Report: Portfolio Income during January 2012